Your balance sheet reflects your current liabilities and assets at any one time. Therefore accruals aren’t reflected here - only the payments realized (both in and out of the business). Unlike the income statement, the cash flow statement focuses on cash actually moving in and out of the business. This document is actually sometimes known as the “accrual income statement” for this reason. Income statementĪs the name suggests, the income statement shows your company’s income for a given accounting period, to give a clear picture of overall financial performance.Īccruals are recorded on the income statement in the period they are earned, which is often not when cash is received or sent. You don’t actually change the previous period’s records, but rather create adjusting entries for all the payments received in the month or quarter you receive them.

#ACCRUAL ENTRY UPDATE#

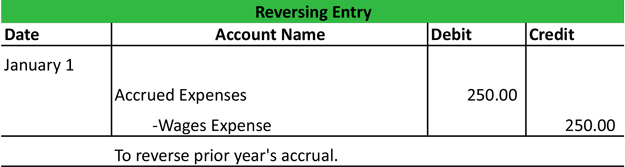

The second step involves adjusting entries, where you update the previous transaction to show that it has been settled. There are two steps: booking the transaction as accounts payable or receivable in a given month, and then recording the actual payment received. Each accrual entry shows an asset or liability for the company in the form of committed payments. Journal entriesĮvery company transaction requires a journal entry in the general ledger, and accruals are no different. We’ll focus on expenses for this section, but of course receivables work much the same way (only as an asset rather than a liability).

#ACCRUAL ENTRY HOW TO#

How to record accruals in financial statementsĪccrued expenses and receivables impact several of your key journal entries. But for large purchases, subscriptions, and corporate services, it’s common for payment to arrive weeks or months after the transaction takes place. Most direct-to-consumer brands will have a low number of receivables - they usually get paid before goods or services are delivered. Invoices sent to customers for goods or services (to be paid in future) These are all the payments the company can reliably expect to receive: Companies will book them against the relevant accounting period, even if the cash statement won’t be updated until later.

In fact, most corporate transactions are committed ahead of time and paid later. Supplier invoices (rent, utilities, services) Payroll expenses such as salaries, bonuses, and vacation days These are any obligatory payment that has not yet been executed, including: Receivables predominantly includes all the payments the company receives from customers. Payables include all expenses and costs that the company needs to pay. Examples of accrualsĪs with most company transactions, we can separate these into accounts payable and accounts receivable.

#ACCRUAL ENTRY WINDOWS#

Payments are booked only when cash comes in or goes out of an account.Īccrual basis accounting: This method considers all committed transactions as assets and liabilities to the company’s treasury, even if there has been no exchange of cash.īecause so much business operates on credit, and because invoices often have 30-90 day windows for payment, most standards consider the accrual basis of accounting to be more accurate. There are two main bookkeeping options for businesses:Ĭash basis accounting: Cash accounting relies on real money flow to monitor business transactions.

0 kommentar(er)

0 kommentar(er)